income tax rates 2022 federal

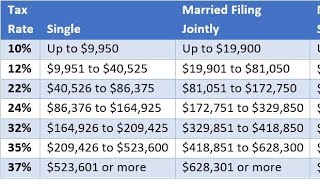

Single filers 10. Here are the marginal rates for tax year 2023 depending on your tax status.

Your 2023 Tax Brackets vs.

. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Using the 2022 regular income tax rate schedule above for a single person Joes federal income tax is 5187. It is increasing by 900 to 13850 for single taxpayers and by 1800 for married couples to 27700.

Empire State Child Credit - 33 of the federal child tax credit ot 100 for. There are seven federal tax brackets for the 2022 tax year. The federal income tax consists of six.

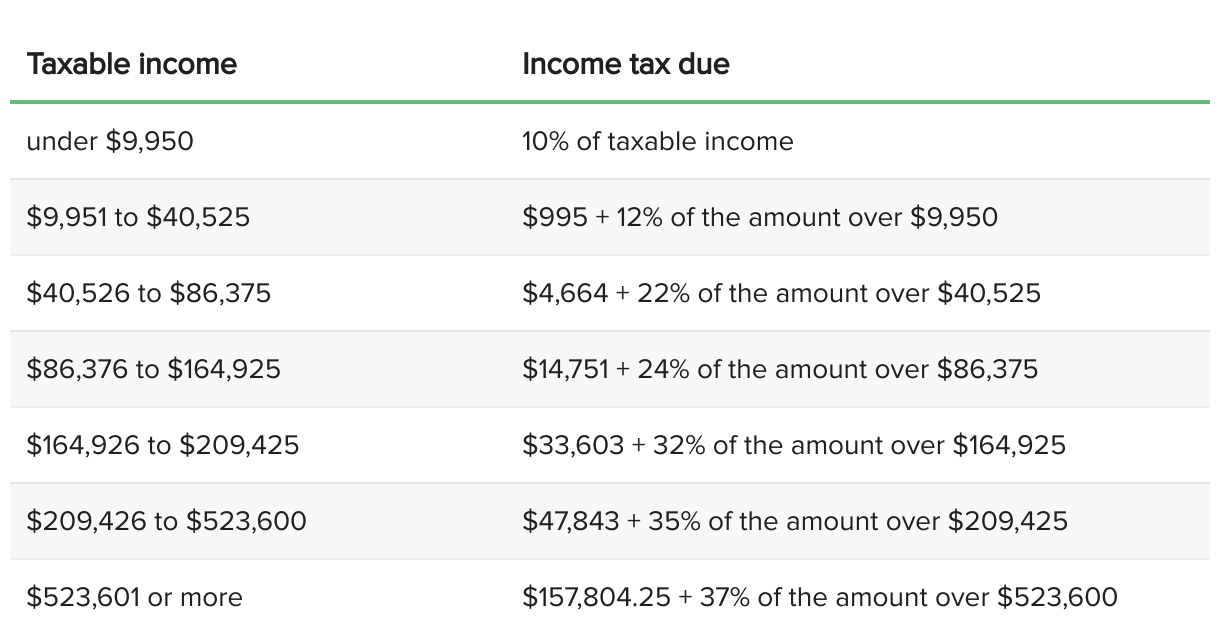

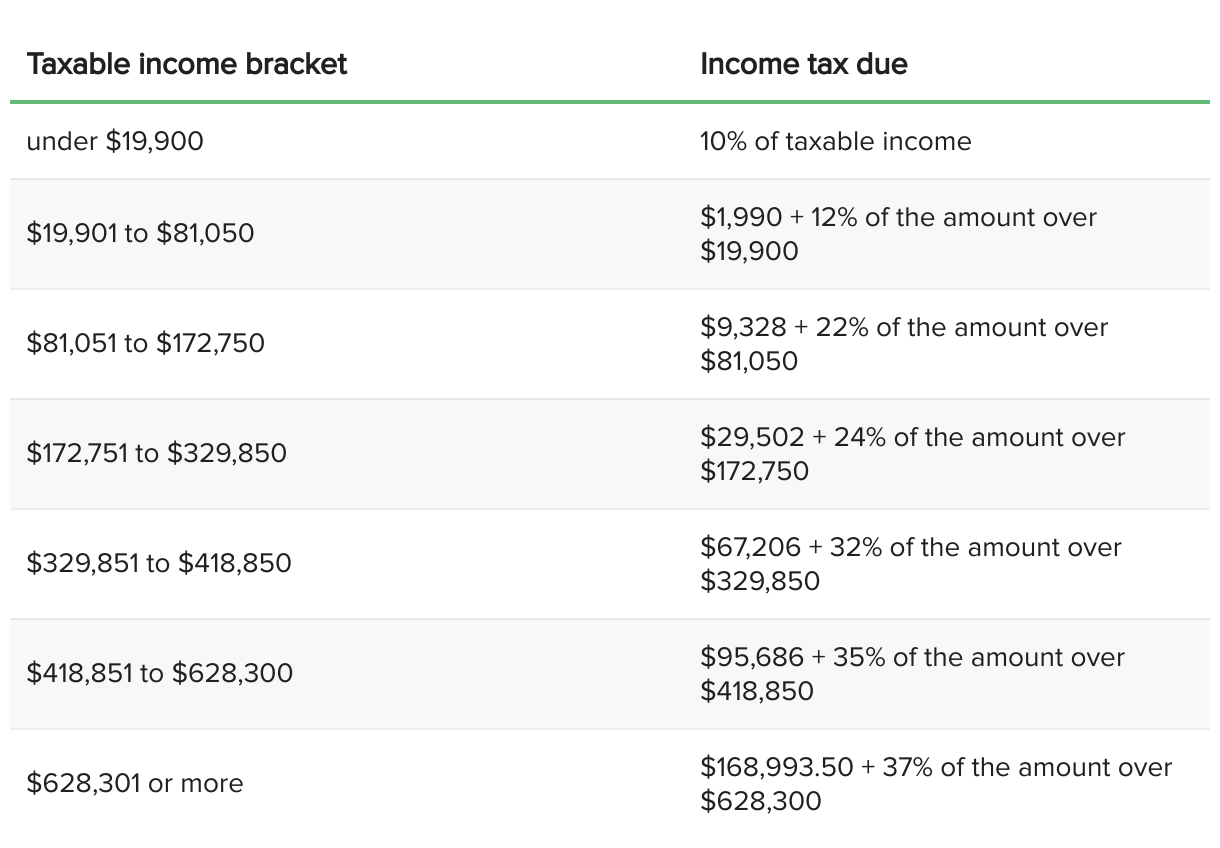

Federal Tax Rates and Brackets. The 2022 Income Tax Brackets. There are seven federal income tax rates in 2022.

2022 Federal Income Tax Brackets. 43500 X 22 9570 - 4383 5187. The seven tax rates remain unchanged while the income limits have been.

Each of the tax brackets income ranges jumped about 7 from last years numbers. Income of 11000 or less 12. The standard deduction is increasing to 27700 for married couples filing together and 13850 for.

The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income. The 2023 changes generally apply to tax returns filed in 2024 the IRS said. 10 12 22 24 32 35 and 37.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. The income brackets though are adjusted slightly for. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households.

Income between 11001 and 44725 22. 2 days agoThe IRS has released higher federal tax brackets for 2023 to adjust for inflation. Heres a breakdown of last years income.

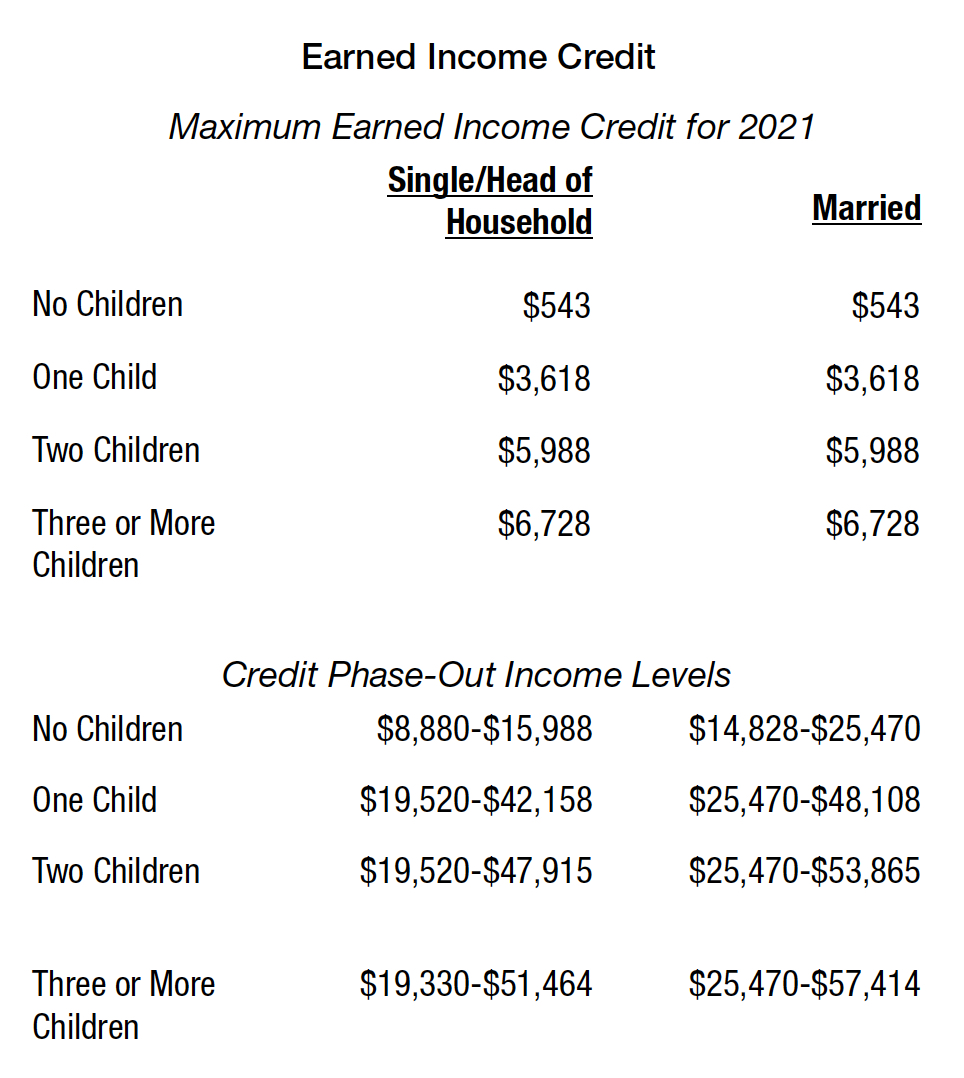

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. 2 days ago2022 tax brackets for individuals. Dependent Child Care Credit - 20 to 110 of your federal child credit depending on your New York gross income.

For heads of household the 2023 standard deduction will be 20800. The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday. 10 12 22 24 32 35 and 37.

There are seven federal tax brackets for tax year 2022 the same as for 2021. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. 10 12 22 24 32 35 and 37.

Importantly your highest tax bracket doesnt reflect how much you pay in federal income taxes. For the 2022 tax year there are seven federal tax brackets. 2022 Tax Brackets.

Whether you are single a head of household. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The additional 38 percent is still applicable making the maximum federal income tax.

The IRS tax tables MUST be used. Below are the new brackets for both individuals and married coupled filing a joint return. If youre a single filer in the.

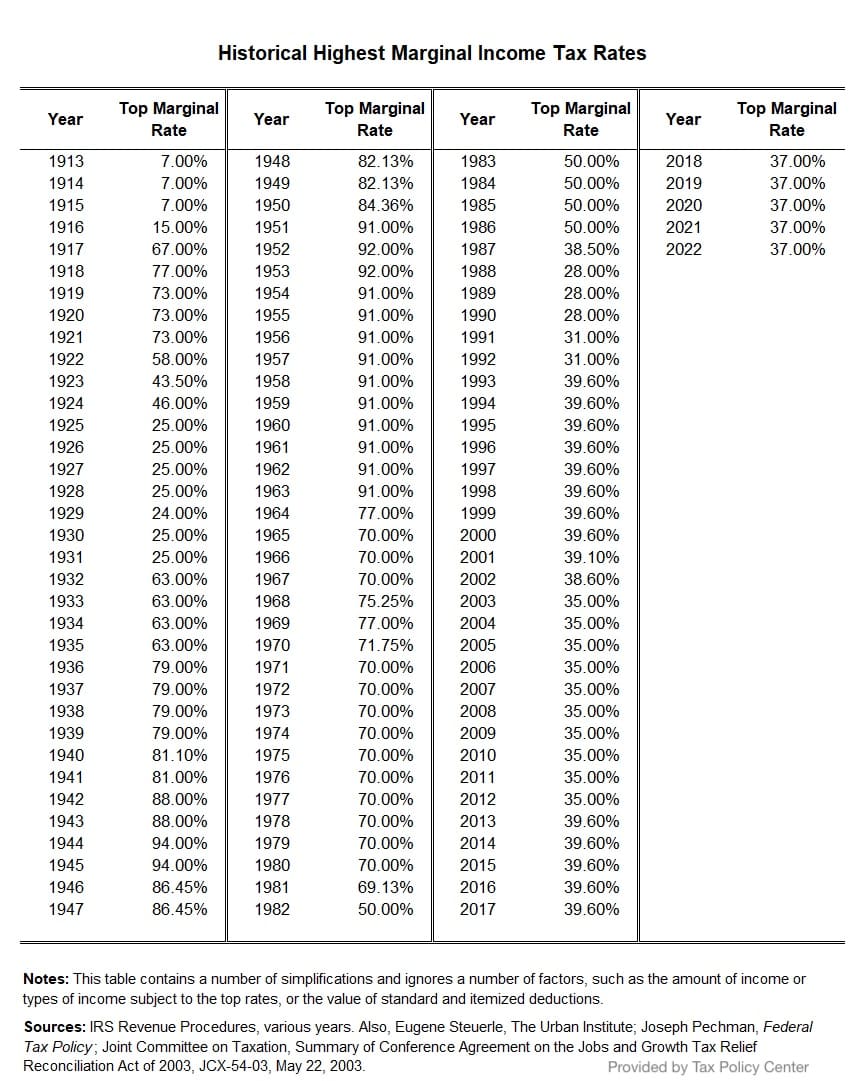

As noted above the top tax bracket remains at 37. Your bracket depends on your taxable income and filing status. The highest income tax rate was lowered to 37 percent for tax years beginning in 2018.

The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code. Your tax bracket is determined by your filing. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married.

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

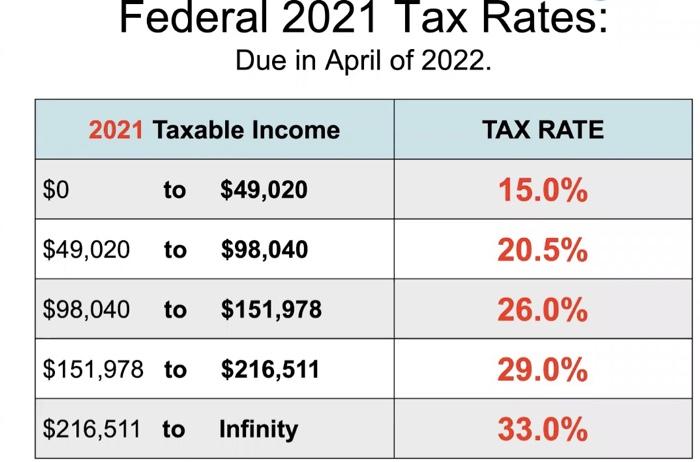

Solved Federal 2021 Tax Rates Due In April Of 2022 2021 Chegg Com

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Income Tax History Tax Code And Definitions United States

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Summary Of The Latest Federal Income Tax Data Tax Foundation

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

2022 Tax Brackets And Federal Income Tax Rates

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

State Corporate Income Tax Rates And Brackets Tax Foundation

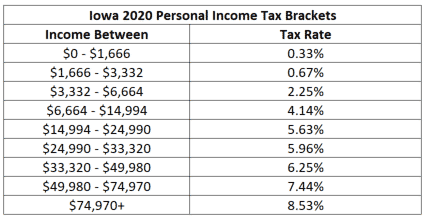

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2022 Income Tax Brackets And The New Ideal Income

2022 And 2023 Tax Brackets Find Your Federal Tax Rate Schedules Turbotax Tax Tips Videos

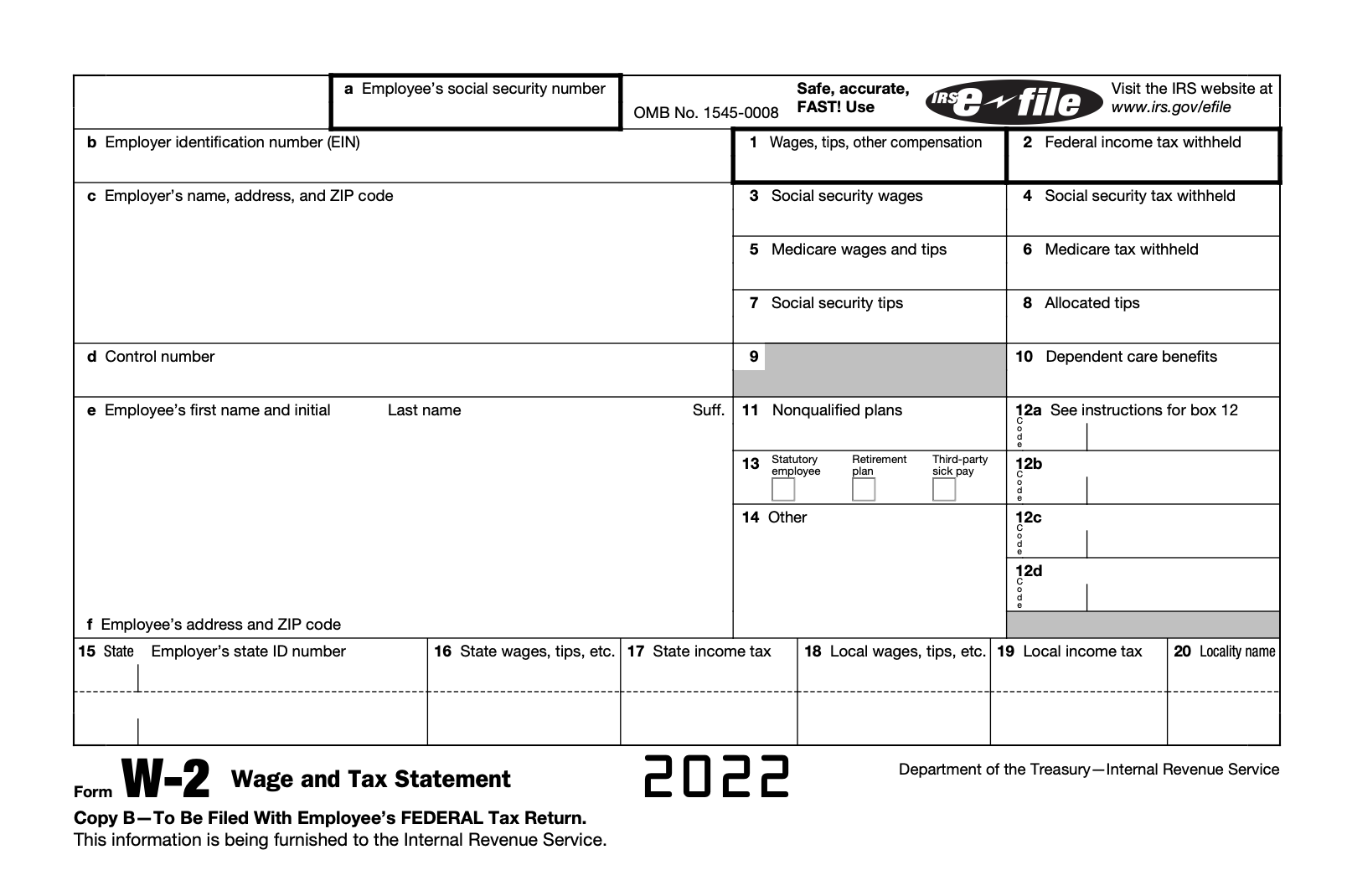

How To Fill Out A W4 2022 W4 Guide Gusto

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Summary Of The Latest Federal Income Tax Data Tax Foundation